community update | understanding the fund balance

For more information, contact Assistant Superintendent Miranda Owsley at owsleym@salineschools.org

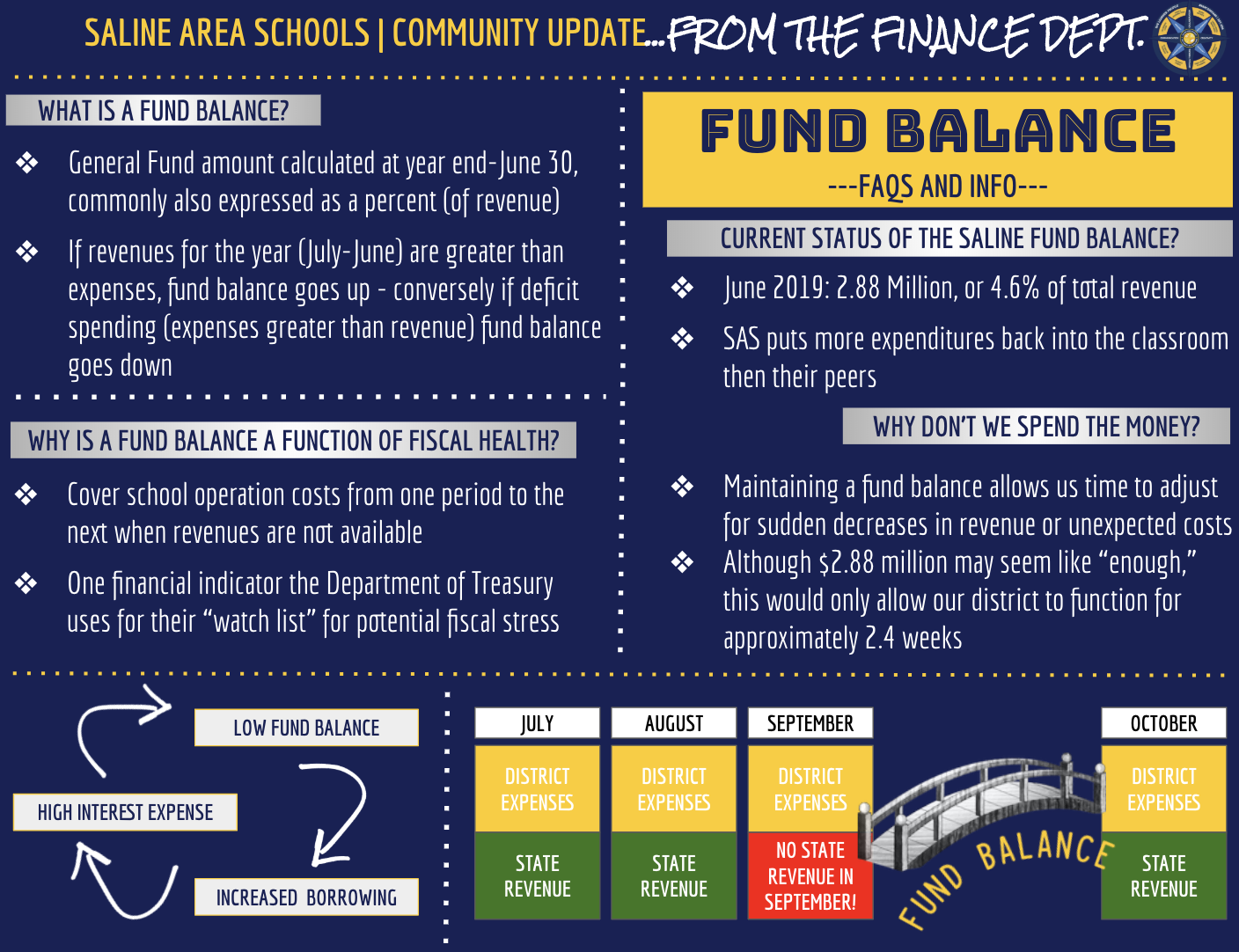

What is a Fund Balance?

Some may know the textbook answer of what a fund balance as: Fund Balance = Assets (what a district owns or is owed) – Liabilities (what a district owes). For schools, that is calculated once a year at June 30th due to the modified accrual accounting structure that schools must use. But an easier way to think about it is the change that happens to the fund balance from year to year. You take the starting balance (end of the prior year), add revenues and subtract expenses. Thus, if you spent more than you take in, fund balance decreases. Conversely, if your revenues are larger than your expenses, your fund balance increases.

Amount or % - Fund balance is often expressed as an amount of money. It is also commonly shown as a percent. Some common ways it is expressed is as a percentage of revenues, restricted revenues or expenses. For example, Saline’s Fund Balance on 6/30/19 was approximately $2.8 million. This divided by revenue equals 4.61%, restrictive revenue equals 5.74% and expenditures equal 4.63%.

General Fund – The Saline Finance Department handles 11 funds, each of these have their own fund balance, however, it is the General Fund that is commonly referred to. Therefore, the Bond Fund, Debt Fund, Sinking Fund, Community Education, etc. are not factored into that calculation.

Why is the Fund Balance a function of fiscal health?

“Bridge the Gaps” - These allocated funds cover a school district’s operation from one period to the next for anticipated times when revenues are not available. For example, the State sends school funding each month (just under $4 million each month), except in the month of September. However, our expenses do not wait. Saline, similar to many schools throughout the State, have to borrow funds to meet their expenditures during this gap in payment.

Department of Treasury - Fund balance is one of the four key financial indicators, along with enrollment, revenues and expenditures that the Michigan Department of Treasury uses in determining if a school district is identified as having potential fiscal stress and placed on their watch list. The Treasury Department mark is a General Fund balance of less than 5% of unrestricted revenue.

Position in Borrowing - The presence of a reasonable fund balance along with a stable trend in the level of the fund balance is viewed favorably by the bond rating agencies. This benefits local taxpayers with lower interest costs on bonds that are issued. Basically, we have to pay less if our fund balance is higher and with the large size of bond funding, this can be a significant amount of money.

Tell me more about the SAS Fund Balance current status.

Saline’s Fund Balance as of 6/30/19 was approximately $2.8 million. This divided by revenues equals 4.61% and restrictive revenue equals 5.74%.

What should it be? – Though there is no one size fits all answer to what a school’s fund balance should be, below are some interesting facts and more data can be found on the interactive charts to the left.

Statewide average is 13.9% (2018-19)

MSBO (Michigan School Business Officials) recommends 15-20%

Michigan Treasury’s starts fiscal monitoring at 5% of restricted revenue

Other peer district data found on charts to the left (similar to Saline in some measure: location, size, academics, community, etc.)

Funding Flows to Instruction – There are very few decisions that are made that do not involve finances as a factor. The lower our fund balance is the more importance that funding takes rather than allowing student success to be the driving factor. In comparison to the other districts in Washtenaw County, Saline continues to direct more funds into instruction (per MiSchoolData 18-19 GF Budget Transparency: Saline 63.6%, Lincoln 63.3%, Ann Arbor 61.7%, Manchester 61.1%, Dexter 60.5%, Chelsea 60.2%, Milan 53.9%, Ypsilanti 52.5%, Whitmore Lake 50.8%).

Michigan Department of Education (MDE) also releases a Bulletin 1014 each year that ranks all schools by selected financial data that helps districts compare their expenditures with districts throughout the state.

Why is it important to have a fund balance (or some may refer to as a "rainy day fund?") In other words, why don't we spend the money?

Perpetuate the Problem - This ties into the last answer, in the fact that we currently borrow/loan funds to help “bridge the gaps.” This borrowing is not interest-free. Thus, the lower your fund balance is, the more you need to borrow/loan. The more you borrow, the more you will pay in interest. This increases your expenditures without increasing revenues, in turn, lowers your fund balance. So one can see how this is a negative cycle that is important to break.

“Seems like Enough” - Though you may view Saline’s fund balance of approximately $2.8 million as “enough”, this is very relative to an organization. For Saline Schools, $2.8 million is only between 2-3 week’s worth of expenses.

Less Control - Being at the mercy of the State for approximately 70% of our revenue, it does not give us a lot of control. The 2019-2020 school year is a prime example of this as we started our fiscal year in July and it was not until late September before the state finalized most of our revenues. We already were well underway into our school year. A larger financial cushion allows the district to avoid drastic changes in educational programs and/or employee layoffs during the year and absorb cuts in State funding. It also grants more time to make tough decisions if they arise to balance our expenditures. On the expense side, our retirement system has changed frequently throughout the past years and is a very large expense that the school is legally obligated to pay just like taxes (approximately 27.5% on every payroll dollar we spend).